Gonka AI: How Uniborn Became a Top-2 Miner

I came across Gonka AI in October 2025, and shortly after an interview with its founders, the Liberman brothers, was released. If you know nothing about Gonka yet, that interview is a good starting point.

Gonka is a Bitcoin-style protocol. If Bitcoin exists for money, Gonka exists for GPUs. It provides incentives to miners so they bring computational power to the network, where clients can actually use it. That’s it.

Like Bitcoin, it’s not a startup you invest in via a SAFE. The only way to join the ride is to participate in the network: bring GPUs, earn GNK (the native token), and wait until it accrues enough value before trading it for a pizza too early through an OTC deal (you remember that meme, right?).

At the time, I found a workaround: joining via a managed mining pool. The upside was simplicity. The downside was everything else — high fees, inflated GPU short-term rental rates, and having to trust people I didn’t know.

When I realized I wanted to double down (not just personally, but on behalf of Uniborn as well) we sat down with the team and figured out how to do this properly.

We set up the right structure, signed a mid-term agreement with a GPU provider, brought in a 24/7 DevOps team on top of our own technical team, and asked a small group of close friends and partners if they wanted to join.

A week later, we closed a private syndicate that ended up operating ~250 H100 bare-metal GPUs, and entered the network as a top-2 Gonka miner.

Why decentralized AI has to happen

Most people don’t notice it yet, but intelligence is consolidating.

A small number of labs now train the models that increasingly decide how we search, write, build, code, diagnose, and automate. They earned that position. Centralized AI moved faster, raised more capital, and scaled first. I'm sure you've heard about the $500 billion Stargate project.

That’s how new infrastructure always forms.

But once a technology becomes foundational, its structure stops being a purely technical question and starts becoming a societal one.

We’ve seen this pattern before.

Money centralized — until open networks made it programmable and borderless.

Communication centralized — until the internet broke distribution open.

Computation centralized — until cloud and open source reshaped who could build.

Each time, the centralized version keeps winning on efficiency, while the open version wins on resilience, access, and long-term alignment.

AI is now crossing that same threshold.

Centralization works. Until it becomes the bottleneck

As AI systems grow, three pressures compound:

- Compute ends up in fewer hands

- Capital requirements rise beyond reach

- Policy, jurisdiction, and incentives begin shaping what intelligence is allowed to do

None of this requires bad actors. It’s simply what happens when something powerful concentrates.

At that point, innovation slows at the edges. Participation narrows. Progress starts to depend on permission.

That’s when decentralized systems become inevitable; not as replacements, but as counterweights.

The open alternative to intelligence

Decentralized AI flips the model.

Instead of intelligence being trained, owned, and distributed by a single entity, it emerges from a network of contributors who are economically and structurally aligned.

- Compute is permissionless

- Contribution is rewarded, not gated

- Intelligence compounds across participants

This isn’t ideology. It’s architecture.

Bitcoin proved that open networks can secure something as critical as money without a central operator. Gonka applies the same logic to AI; not by competing head-on with frontier labs on day one, but by building the open substrate they can’t.

Why we believe Gonka is the most probable winner

Most decentralized AI networks don’t fail because the idea is wrong. They fail because they waste resources.

In many crypto systems, most compute exists purely to keep the system alive. GPUs burn cycles to reach consensus or validate blocks — work that produces no value outside the network. The upside flows to passive capital, not to those who provide compute.

That structure doesn’t scale intelligence. It just secures a token.

Gonka takes the opposite approach.

Useful work only

In Gonka, compute isn’t spent on ceremony. Nearly all contributed resources are directed toward real AI workloads — inference and tasks someone would otherwise pay a cloud provider to run.

No staking layer skimming rewards. No artificial complexity. Just machines doing useful work and getting paid for it.

That single design choice changes everything.

What this unlocks immediately

Once compute is rewarded for usefulness rather than possession, three things happen quickly.

First, unused GPUs wake up.

Not just industrial data centers, but gaming rigs, university clusters, and regional infrastructure that would never compete with hyperscalers on their own. Aggregated, they become real capacity.

Second, developers get access without gatekeepers.

Inference becomes permissionless and cheaper — not because it’s subsidized, but because the network removes the margin and friction of centralized intermediaries.

Third, the token stops being abstract.

GNK isn’t backed by narrative. It’s backed by work.

Each unit represents measurable compute that had to be paid for, powered, and delivered. As more GPUs join, producing GNK becomes harder. The marginal cost rises. Scarcity isn’t engineered; it emerges.

That’s the same dynamic that made Bitcoin durable.

Why this compounds

Decentralized networks don’t win by being elegant. They win by making participation rational.

As Gonka grows:

- More GPUs increase total capacity

- Higher capacity attracts real demand

- Demand raises the cost of production

- Higher costs strengthen the economic floor

At that point, the network defends itself; not through ideology, but through economics.

That’s why we don’t see Gonka as just another decentralized AI experiment.

What Gonka could become if it keeps growing

Gonka is young.

The network went live in August 2025, roughly four months ago at the time of writing. Most infrastructure projects are still arguing internally at that stage. Gonka is already running, and developers are already using inference via the network (though it’s not the focus right now; demand for GPUs is unlikely to be scarce for decades to come).

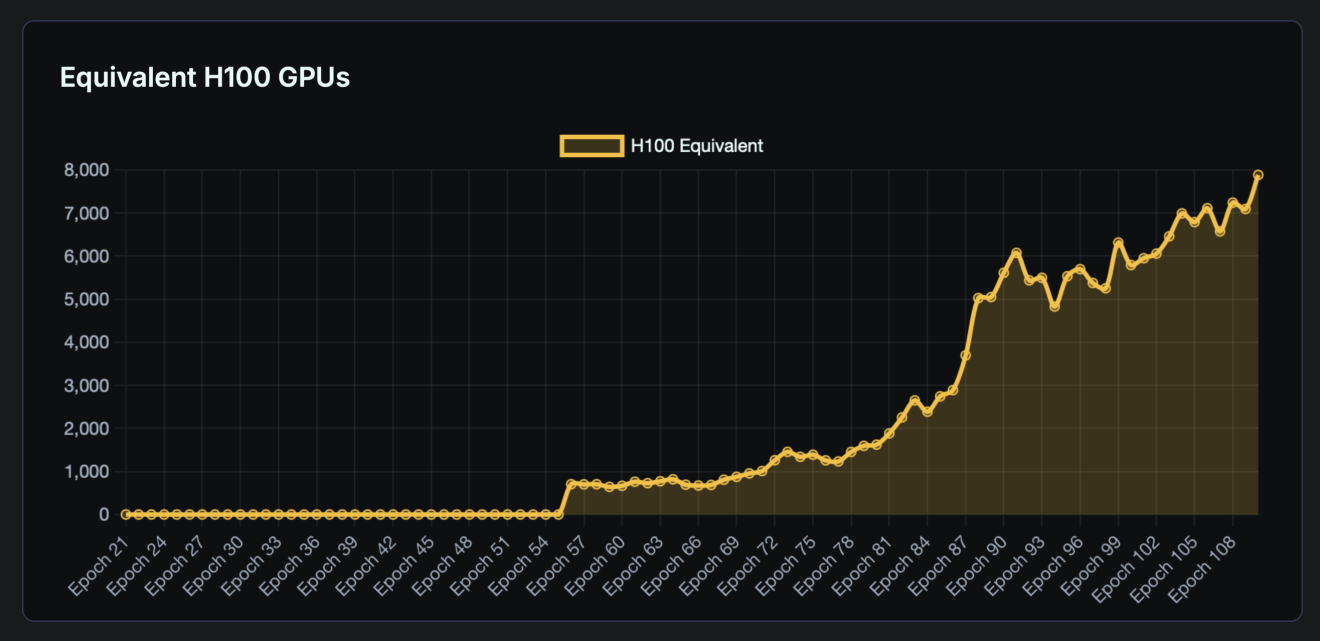

Today, it aggregates roughly 8,000 H100-equivalent GPUs. That number matters less than how it got there: organically, from distributed contributors, without procurement cycles or centralized capex.

One month ago, the network had around 1,600 GPUs — roughly 5x less than it does today (as of December 15, 2025).

At the current size (~8,000 H100 equivalents) and assuming a steady ~10% weekly growth, the math of catching up the centralized peers looks roughly like this:

- 35k GPUs (Nebius-scale): ~4 months

- 60k GPUs (large regional clusters): ~5 months

- 200k GPUs (xAI Colossus range): ~8 months

- 250k GPUs (CoreWeave scale): ~8–9 months

- 1M GPUs (OpenAI-class cluster): ~11–12 months

These are theoretical timelines of course, as growth never stays perfectly smooth.

[calculations by https://x.com/gonka_ai_news]

Where things are today

GNK is not listed yet.

There is no liquid market to absorb size. Practically speaking, you can’t buy more than about $1k worth without paying roughly $3 per GNK or more.

At the same time, current mining economics imply production closer to $1 per GNK, depending on hardware and energy costs.

Bitfury — one of the largest Bitcoin miners outside China — recently disclosed a $50M investment in Gonka, including the purchase of 20M GNK from the community pool at $0.60 per token. If this post caught your attention, I strongly recommend reading George Kikvadze’s write-up on why they think it’s the next Bitcoin.

What’s my strategy?

I’ve been asked multiple times over the past week what my price target is, or what I expect the token to trade at 2–3 months after listing. Honestly, I don’t think about it that way.

Venture investing, especially early-stage, isn’t about 2–3 month horizons or 5–10x returns.

In a theoretical scenario where Gonka turns out to be a generational opportunity, I don’t want to sell it for many years. Otherwise, I’ll end up as a meme case study, and have nothing interesting to tell my grandkids).

If Gonka’s growth slows, the story changes. But we tried and it was fun.

If it doesn’t, Gonka stops being an experiment and starts behaving like infrastructure.

Purely mechanically.

This post reflects our own views and experiences. It is not investment advice. We are participants in the Gonka network and therefore biased. The mining pool described here is closed at the time of writing. Do your own research and build your own view, always.

Uniborn is a community-led platform for sourcing, sharing, syndicating, and amplifying startups.

Uniborn is a trade name of Uniborn OÜ, registry code 16515953, Rotermanni 6, Tallinn, 10111, Estonia.

We are not intended to be a substitute for legal, tax or financial advice.

Uniborn OÜ is licensed by the Estonian FIU as Trust and Company Service provider, operating license FIU000420.