"They've Already Crossed the Valley of Death": Why Bootstrapped Teams Deserve Investors' Attention

The startup world is populated, among others, by bootstrappers — the founders who run a company on personal finances or operating revenue. Such self-starters are often eager to share their achievements — but are still overlooked by investors. And even when VCs do catch a glimpse of a self-made startup, it is usually taken with a grain of salt.

This selectivity makes sense for VC funds: backing bootstrappers fits poorly into their mantra that not every million-dollar venture can transform into a billion-dollar juggernaut (while VCs’ economic model needs juggernauts to break even). But as for angel investors or their syndicates, we at Uniborn advocate for keeping bootstrapped startups on the radar.

In fact, beginning angels are even better off investing not only in rocket science projects but also in stable ones. Such a strategy prevents missed opportunities on both ends. Angels won’t waste promising ventures with a not-so-big but guaranteed profit and founders get the chance to scale their dreams.

How VC-backed and self-funded startups differ

For bootstrappers, independence reigns, while VC-funded companies chase ambition and scale — so what else is there to talk about? Spoiler: not everything is so clear-cut.

Intentions aren't the only factor determining the starting point; it's often about the nature of the project itself. Imagine two startups: one is a spin on an existing business model that can make money right here and now (think SaaS marketplace for food delivery), while the other harbors an innovative concept that lacks a stable revenue stream but has the potential to bomb the market later (picture an app for co-investing in beehives). Other things being equal, venture investors tend to lean toward the latter when faced with these choices.

In other words, ventures embrace more risks and chart-topping expected returns, while bootstraps embody business classics.

What else?

- In the bootstrap reality, founders enjoy more autonomy and less pressure, but they also contend with limited financial resources, networking opportunities, and outside expertise.

- For venture-backed startups, revenue serves as just one indicator of product validation, whereas bootstrappers see it as the primary metric.

- Venture projects require a broader skill set from their teams, particularly in networking and financial management.

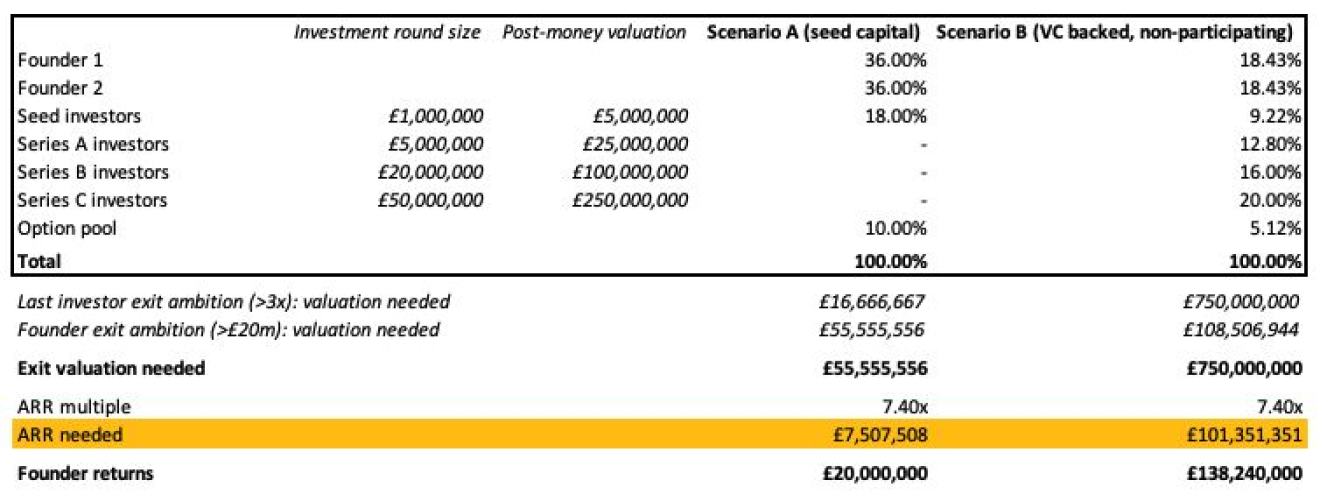

Richard Abrahams, Sprout’s co-founder, sheds light on another critical differentiator: the exit strategy. Through two fictional projects, he illustrates the contrasting outcomes for investors when comparing modest external investments (say, from friends and family, almost akin to bootstrapping) to full-fledged VC investments.

In the case of bootstrapping, of course, it's easier to sell your stake when the time comes, while the venture money must yield certain results. However, thanks to this race, again, the final payoff in the VC-backed story can be manifold — sometimes dozens or hundreds of times greater than for self-starters.

So why should angel investors look at bootstrappers?

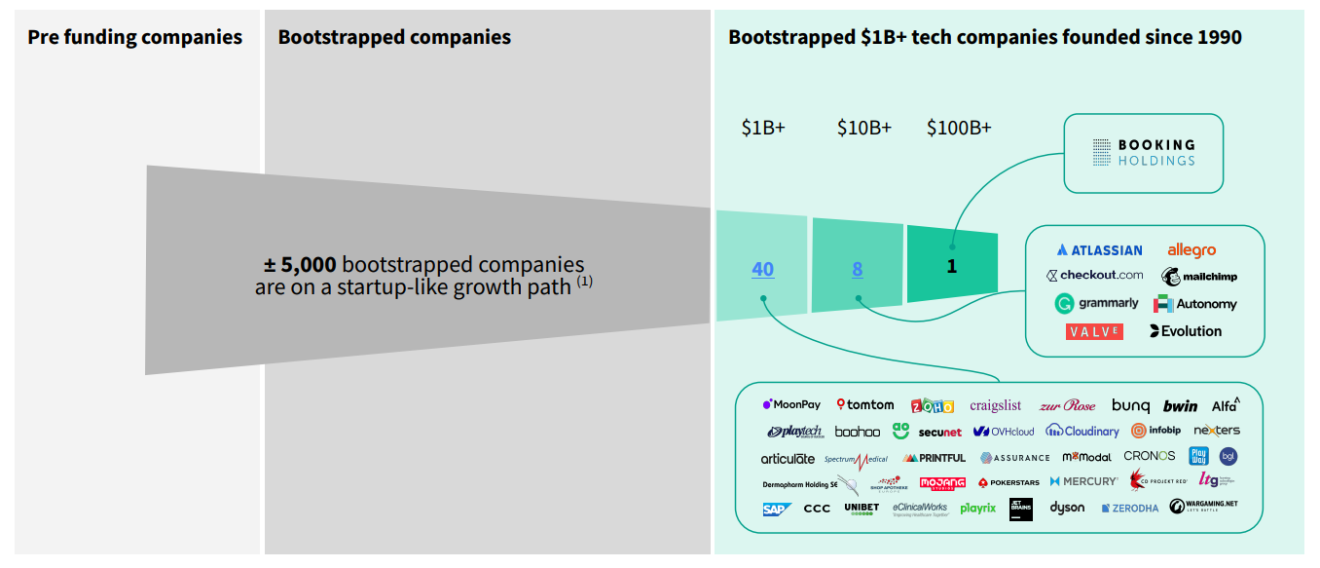

Sure, you've heard about giants like SurveyMonkey, Mailchimp, Atlassian, Shutterstock, Basecamp, ConvertKit, Buffer, and Shopify — they're living proof that bootstrappers can grow into multimillion-dollar companies.

But there are not many big names. According to fresh Dealroom estimates, around 50 startups have risen to the billion-dollar level without the crutch of VC. That's just a 4% sliver of all the unicorns out there. Meanwhile, for VC-backed startups, it's like a one-in-a-hundred shot at the unicorn club.

No wonder. Self-funded teams aren't the disrupt-and-scale type; they're all about resilience and turning a profit from day one. Gitnux's got some statistics to back it up:

- Bootstrappers boast an annual ROI of 49%, while their VC-funded counterparts settle for 39%.

- At the five-year mark, 73% of bootstrappers are still standing tall, compared to 32% of VC-funded ones.

- Bootstrappers flaunt a 61% success rate, leaving VC-funded companies at 41%.

However, transitioning from one category to the other isn't a rare occasion. So, looking at bootstrappers certainly pays off for investors because self-made teams are...

...already profitable

Self-sustaining startups often weather storms alone, so they are forced to release a product and start earning money quickly. As Kurt Beyer, a lecturer in entrepreneurship and innovation at UC Berkeley’s Haas School of Business, puts it, bootstrapped teams "may have gotten through the ‘valley of death’ already, they may have achieved product-market fit, may have some revenue, so in a way they have de-risked the startup."

...masters of efficiency

Not only did these startups survive the valley, they did it on a shoestring. They had to know how to be lean and mean, so they are very efficient and can make sound decisions about costs, Beyer adds. And yes, they are more resilient in a recession.

...customer-centric to the core

The incredibly innovative projects that typically interest angels often lack one important advantage: their ideas do not have a definite client. In contrast, bootstrapped startups are often forced to cultivate a deep connection with their customers. This hands-on approach translates into a product-market fit that's fine-tuned to perfection. Which means it will definitely pay off.

...off the beaten path

In the competitive world of VC funding, finding gold in seemingly unexpected targets can be easier than digging where others have dug a hundred times before, especially for investors with small checks, thinner networks, and deep industry expertise.

And just to set the vector

If I was convincing and you're already looking to connect with bootstrapping startups, you may wonder where to find good pretenders. Twitter and LinkedIn may seem the obvious choice. But beware of founders who talk the talk more than walk the walk.

Here are the places where you are more likely to find a worthwhile project: themed platforms and forums like Indie Hackers, expos, and conferences like WebSummit's Alpha. It's also worth checking out the G2 and Capterra catalogs. Or browse specialized business-for-sale sites like Flippa and Acquire.

Another — less obvious — method involves searching through startup visa communities or national business registries with filters for industry, turnover, and date of incorporation. These registers are usually public, especially in Northern Europe.

There is only one caveat to keep in mind: if you've set your sights on promising bootstrapping founders (and they're willing to accept your participation), be prepared to roll up your sleeves. These independents may need a crash course in San Francisco Bay-style financial accounting and a lesson or two in options and shares. Passive investing won't cut it here.

Cover image: Unsplash

Uniborn is a community-led platform for sourcing, sharing, syndicating, and amplifying startups.

Uniborn is a trade name of Uniborn OÜ, registry code 16515953, Rotermanni 6, Tallinn, 10111, Estonia.

We are not intended to be a substitute for legal, tax or financial advice.

Uniborn OÜ is licensed by the Estonian FIU as Trust and Company Service provider, operating license FIU000420.