Weekly VC Insights by Uniborn #22

As scorching heat gives way to wild rains, our team continues to gather the juiciest updates for European angel investors. Don't miss them out — subscribe now!

🔥 The progeny of GDPR is set to shape "a safer internet for everyone." At least for the Europeans

A few years back, Europe's game-changing GDPR shook up the market by curbing BigTech's appetite and empowering internet users to control their data. Now, a fresh force known as the Digital Services Act (DSA) has entered the scene. This law extends consumer protections to online services by forcing IT platforms to limit advertising and rigorously moderate content.

Currently, the legislation impacts only 19 tech giants, including AliExpress, Booking, Facebook, TikTok, and more. This already comprises a whopping 45 million active users within the EU alone, but the roster is bound to expand. Notably absent from the list are Netflix, AirBnB, and PornHub, but they’ll likely fall under its purview as well. Eventually, almost every online service that people interact with on a daily basis — whether it's scrolling through reels on Instagram or ordering sneakers on Amazon — will feel the effects of this law.

Failure to comply with the DSA could spell trouble for online platforms, resulting in significant fines (up to 6% of their global revenue — a staggering $16 billion in the case of Google, for example) — or even potential bans.

As Emilie Kuijt, Data Protection Officer at AppsFlyer, said, "Beyond the GDPR, the DSA is one of the most impactful regulations we’ve seen. If you’re dealing with data in the EU, even if you’re not a VLOP, this is the moment to get your act together. Pun intended 😉."

For investors, this serves as a clear signal to reevaluate business models and transparency levels of led startups, especially e-commerce platforms, social networks, streaming platforms, etc.

We recommend reading the article by Sebnem Elif Kocaoglu Ulbrich for a deeper understanding.

🔥 Gender gap depends on maturity: growing startups show lower pay and representation for women in key roles

This data is only for the fintech sector, and only for Europe — but is the grass greener in other markets? There is no reason to think so.

What we're talking about: Ravio's analysts looked at the trajectories of 80 European fintech startups and uncovered an inextricable link within the employment hierarchy, connecting the gender gap to various stages in a company’s lifecycle.

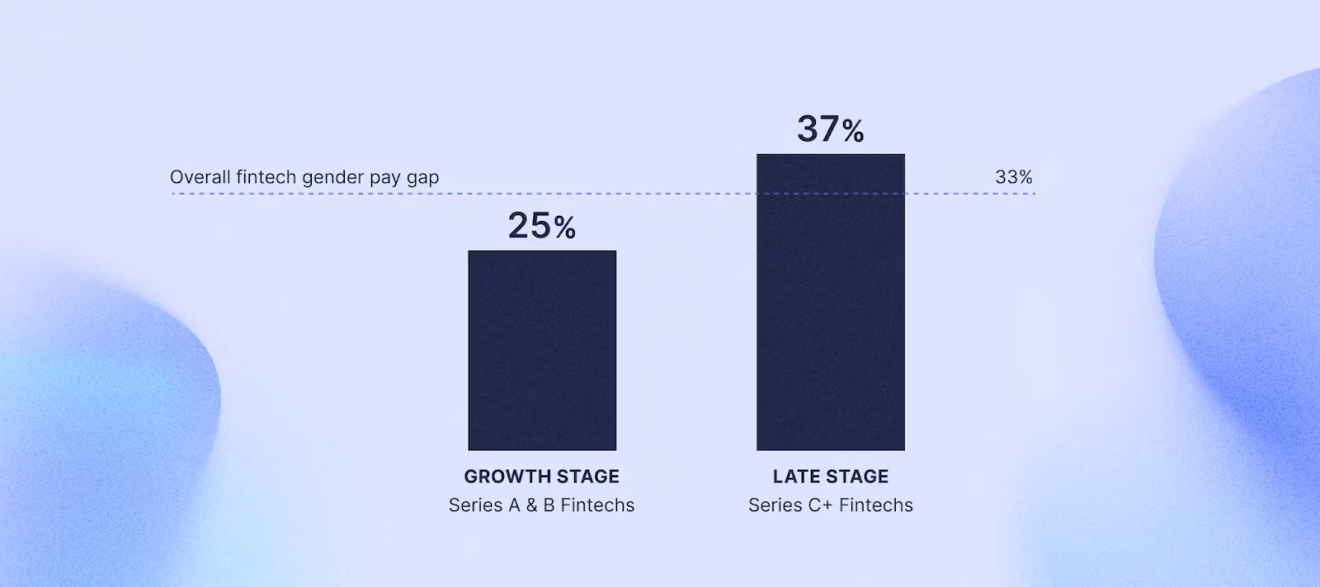

Here's a revelation: during series A and B, the gender pay gap stands at 25%. By contrast, the broader fintech industry struggles with a higher average of 33.18% (and the IT industry average is 32.89%). But brace yourself for the jump when the C+ series arrive — the gap catapults to 37%.

The reasons for this disparity are clear:

- First, as companies evolve, the landscape changes, marking a surge in managerial hiring. So labor costs jump by 4 points, from 19% in the growth phases to an impressive 23% in the later stages. Unfortunately, this boost is conducive to men’s advancement, resulting in a shift of women’s influence from 41% to 28%.

- Second, the median annual salary for males increases by a healthy 15% as they move through the stages, while females experience a more modest 4% increase.

For angel investors, these stats should serve as an additional incentive. If presented with two fairly equal projects, throw your weight behind the one that has not only cultivated an inclusive environment from the start but has maintained it throughout its transitions. Remember, a diverse team isn't just for show on Twitter; it brings real business benefits by eliminating narrow perspectives.

We recommend reading the Ravio report for a deeper understanding.

🔥 While we're on the subject of European fintech, here are a few more unfortunate statistics to consider

In the world of D2C fintech, companies are grappling with a real challenge when it comes to securing funding. And to make matters worse, this struggle is further heightened by an investment winter.

Consider this: last year, Europe experienced a significant drop in deal activity, the lowest level in seven years. The turmoil continues into 2023, with the investment landscape in the first half of the year in stark contrast to the previous year's performance. According to PitchBook, only €1.7 billion was raised in the first six months of 2023, barely a quarter of 2022's €7.8 billion.

For startups focused on consumer payments, the issue takes on a darker hue.

Within this subsector, consumer payments startups managed to secure at least 10% of the funding they raised last year, while credit and banking startups faced a more severe environment and secured only 7%.

On the bright side, the alternative lending sector gives us hope, as it continues to attract VC funding and is on track to surpass 2022’s earnings by a significant margin.

Navigating the consumer financial technology space has never been a walk in the park: the costs associated with customer acquisition are high and maintaining consistent user engagement is challenging. Still, it's worth noting that when a company manages to thrive in the realm of D2C fintech, its success resonates profoundly.

We recommend reading the Sifted review for a deeper understanding.

Cover image: Unsplash

Uniborn is a community-led platform for sourcing, sharing, syndicating, and amplifying startups.

Uniborn is a trade name of Uniborn OÜ, registry code 16515953, Rotermanni 6, Tallinn, 10111, Estonia.

We are not intended to be a substitute for legal, tax or financial advice.

Uniborn OÜ is licensed by the Estonian FIU as Trust and Company Service provider, operating license FIU000420.