Weekly VC Insights by Uniborn #5

Hello! Uniborn is back on the line. We read a lot (really a lot) about the European startup scene to share with you the most unexpected and vital materials.

Inside: Top 5 myths about European venture, top 100 career startups, decline of gender bias, and much more.

🔥 Giant Companies Are More Vulnerable Than You Think And Your Startup Has More advantages against them than you may realize

Eren Bali, a serial entrepreneur and founder of Carbon Health, lived through any founder's worst nightmare: Google launched a product with an identical concept. However, says Eeren, the tech giant didn't get anywhere, and his startup continued to develop and scale-up. So are corporations that invincible?

An unconventional look at a common situation in an Inc. article.

🔥 The best European startups to work for in 2022

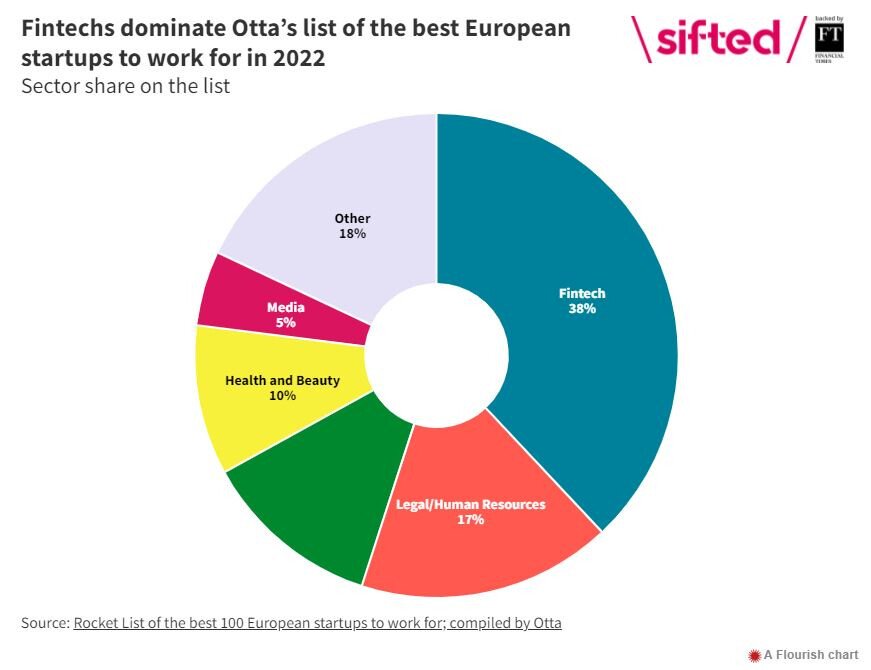

Miriam Partington on Sifted reviewed Otta's Rocket List, which features 100 startups with the best career opportunities. It is based on the company's employee growth rate, financial investment, and overall mission.

38% of the companies on the list are fintechs! See the complete list of startups in the article.

🔥 Reducing Gender Bias: Four Questions To Ask VC Firms Before Investing

Julie Castro Abrams, an experienced CEO and founder of How Women Lead and venture capitalist wrote explicitly for Forbes about what questions can make the VC industry doubt its "boys club" status quo and, potentially, lead to a more just industry.

"Venture capital firms with 10% more female investors on staff make more successful investments at the portfolio company level, have 1.5% higher fund returns, and see 9.7% more profitable exits." A good reason to ponder, right?

Look for all questions in Julie's article.

🔥 Five 2022 European tech myths debunked

Sifted has published an article that debunks common myths about the current state of European venture capital. In particular, the authors provide evidence that while the weakening of the currency has made European startups more attractive to foreign investors, American money has yet to flood the market.

They also say that by and large the activity is observed on the series A rounds, not seed and pre-seed, as it is commonly thought and, in fact, that not all European markets are in the same position.

Don't miss the full version.

🔥 Just Because VCs Won't Fund Your Company, It Doesn't Mean It's Not Financially Backable

In an Inc. article, VC Henri-Pierre Jacques of Harlem Capital shared a fresh perspective on present-day fundraising. Do you actually need venture capital? The sooner you shift your focus to other ways of raising capital, the more time you have to grow your business.

Perhaps for many companies, the only way to survive is to simply stop chasing venture capitalists. Read more in the article.

Uniborn is a community-led platform for sourcing, sharing, syndicating, and amplifying startups.

Uniborn is a trade name of Uniborn OÜ, registry code 16515953, Rotermanni 6, Tallinn, 10111, Estonia.

We are not intended to be a substitute for legal, tax or financial advice.

Uniborn OÜ is licensed by the Estonian FIU as Trust and Company Service provider, operating license FIU000420.