Results of the year from TechCrunch, Sifted, Tech.eu, and others: Weekly VC Insights #9

We are in the last weeks of December, so it is time to recap and make forecasts. Leading European and world media have published their ratings, reviews, and lists, and we have collected the most gripping there were over the past week.

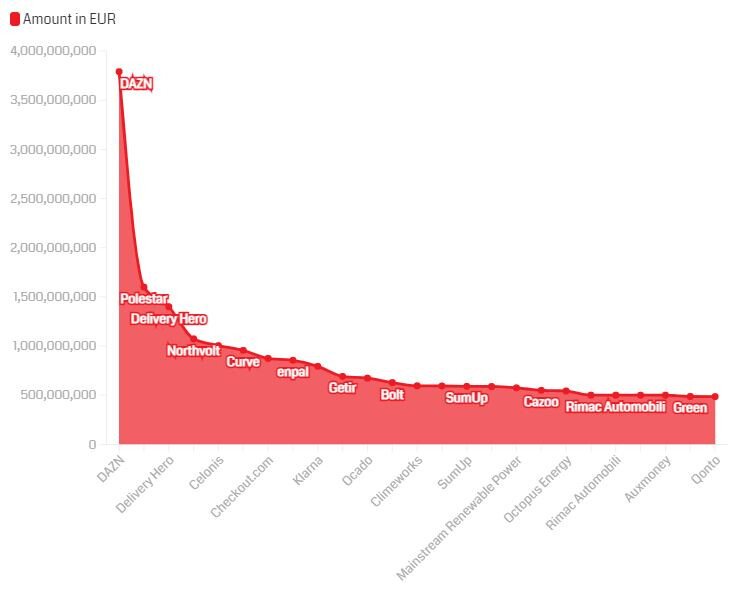

🔥 The top 25 European tech funding deals of 2022

The editors of tech.eu conducted an open-source study and ranked the 25 most profound deals among European startups in 2022. Interesting observations:

- the most significant number of transactions (eight) occurred in British companies;

- each of the five largest transactions was worth more than 1 billion euros;

- seven out of 25 deals were fintech startups;

For the list of finalists and other details, see the article on tech.eu.

🔥 The state of European unicorns: 2022 wrapped

The outgoing year gave Europe 47 new unicorns, which, although less than the 69 in 2021, is still a good number, given all the upheavals. Sifted analyzed data on the activities, financial performance, and founders of all these companies.

Some statistics:

- most of the new unicorns are run by solo founders;

- only 3.1% of founders are women. This result is even worse than last year’s;

- almost a third of the total number of companies work in the fintech sector;

- unicorns first appeared in new sub-sectors of ClimateTech;

Read the full report from Sifted analysts here.

🔥 VCs say superpowered software, a dearth of new funds, and rampant M&A are among the tech trends to watch in 2023

Business Insider reached out to Accel, Sequoia, Lightspeed representatives, and other venture capital companies to share their vision of how the market will change in 2023.

Here are some of their findings:

- right now, the next iconic app after TikTok is being born, which is aimed at generation Z;

- neural networks add value to employees who can think creatively and skillfully direct AI;

- venture investors will impose more stringent requirements on startups;

- companies will want to see their employees in the office again;

- new venture funds will appear less frequently;

See the complete list of predictions at Business Insider.

🔥 Top Companies Driving The 2022 Midas List Europe

Forbes and partners have released the sixth annual ranking of startups that bring the most profit to venture investors in Europe and the Middle East. In 2022, the top ten were: Stripe with an estimate of $95B, Roblox ($49.1B), checkout.com ($40B), Spotify ($26.5B), and others.

Only one company on the list went public this year, Indonesian SuperApp Gojek (valuated at $27.9B).

See the complete list of this year's record holders at Forbes.

🔥 OK, now. Now we're going to see more startups acquire other startups

According to Crunchbase data, as of December 13, as many as 1,291 startups have been acquired by other startups this year. Last year the figure was almost identical. However, in 2023, according to Rebecca Szkutak from TechCrunch, the numbers will be much higher.

Please read the article at the link to see its arguments.

Cover image: Unsplash

Uniborn is a community-led platform for sourcing, sharing, syndicating, and amplifying startups.

Uniborn is a trade name of Uniborn OÜ, registry code 16515953, Rotermanni 6, Tallinn, 10111, Estonia.

We are not intended to be a substitute for legal, tax or financial advice.

Uniborn OÜ is licensed by the Estonian FIU as Trust and Company Service provider, operating license FIU000420.