Urban Oases: Angel Investors Edition

While San Francisco Bay may still be the go-to destination for VCs, Europe has emerged as a formidable contender. In this dynamic arena, cities like Stockholm, Berlin, Amsterdam, and Dublin have also found a recipe for startup triumph, combining a vibrant entrepreneurial spirit, access to talent and technology, and government incentives.

No wonder there's tons of information on where to launch a startup in Europe, but surprisingly little on where an investor could settle. Of course these two worlds overlap, but at Uniborn we decided to collect the best local hubs especially for aspiring angel investors.

Power places for founders (and thus investors)

Let's first look at what savvy people are saying about the prime playgrounds for entrepreneurs (because, let’s be honest, what venture capitalists will do in a place with no visionary founders, right?).

According to the latest fundraising rankings from PitchBook, the reigning champ of VC action is none other than the UK's bubbling capital, London. It has dominated for more than a decade, but the competition is heating up. In the first quarter of this year, London secured the lion's share with 45% of all investment raised in the top five European cities, with Paris hot on its heels with 25%. Berlin came in third with nearly 17%, while Tel Aviv and Munich rounded out the top five.

In 2022, London was also a powerhouse, boasting an impressive 52% (that's a whopping €26.6 billion), while Paris claimed 16% (that's €8.2 billion), and Berlin brought in just under 12% (€6.1 billion). At the time, Stockholm joined the top ranks instead of Munich.

But it's not all about the cash flow, is it? We have to consider the startup ecosystems. Startup Genome's verdict? London is still the undisputed king. On a global scale, it is second only to Silicon Valley sharing its spot with New York. And then we have Tel Aviv that snuck into fifth place (yes, we know it's not technically Europe, but their VC scenes intermingle so often that you could be sipping coffee in Tel Aviv while investing in the Baltics).

Once we run past the top ten, EU cities pop up. Berlin holds 13th place, Amsterdam nabs the 14th spot, and Paris comfortably resides at 18th. Keep an eye on Zurich, too — to break the top 30 this year, it had to climb ten positions, marking one of the most notable improvements in Europe.

Startupblink echoes the sentiment, hailing the British, French, German, Swedish, and Dutch capitals as top European startup hubs. EU-Startups is on board with this notion, too.

And for those looking for slightly off-the-radar but promising destinations, TravelPerk highlights gems like Barcelona, Ljubljana, Prague, Lisbon, Athens, Florence, and Hamburg. EU-Startups’ team complements this list with Helsinki, Dublin, Tallinn, and Copenhagen.

Capitals or no capitals — that is the question

As you see, the VC world tends to revolve around capital cities. They are epicenters where startup accelerators thrive, groundbreaking conferences and competitions unfold, and top-notch universities exist — the realities of urban centralization.

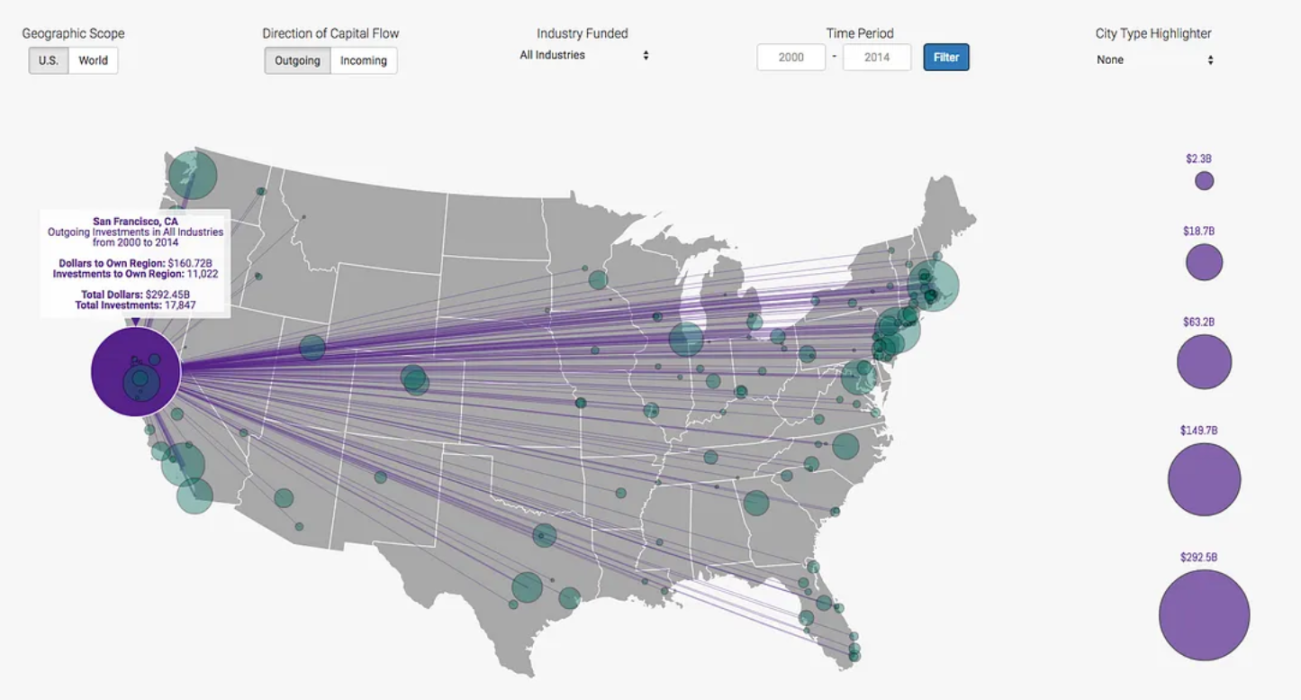

Take a look at this visualization of funding flows in US cities. The pattern is crystal clear — the focal points overlap with the most self-sufficient and dynamic cities.

So unless we're talking about the UK or Germany (and possibly Italy and Spain), which have pretty robust cities outside their economic centers, it's better for an investor to be located in the capital with their concentrated pool of opportunities, resources, and connections.

Dealroom's data delivers a stark reminder. Among the top twenty European cities for VC fundraising, the UK has four major contributors, while in France, a staggering 80% of all money raised in the country goes to Paris. The disparity is so pronounced that in the first quarter of 2023, Parisian startups secured over a billion euros, leaving the next city on the list, Grenoble, with a mere 5% of that sum.

However, settling beyond the capital cities offers its advantages. Regional areas present less competition, so you can hone your investment skills in a calmer atmosphere and get your eye on a future unicorn at the super early stages. Moreover, living costs are often more affordable outside the capital, while the ecology and work-life balance tend to be superior.

If you're not quite ready to splurge on capital city living or endure the daily grind of urban traffic, consider planting your roots in one of these promising cities:

- Munich

- Hamburg

- Cambridge

- Madrid

- Milan

- Bristol

- Edinburgh

- Manchester

- Marseille (proof that France is more than just Paris)

Of course, you're not limited to this list, but branching out comes with a high risk of feeling like this lonely creature in the picture below.

So, angel investors, take your pick! You can settle comfortably in any of the vibrant locations — just choose the one that tickles your taste buds. Consider climate and time zones, cuisines, and housing markets — and pay special attention to tax considerations.

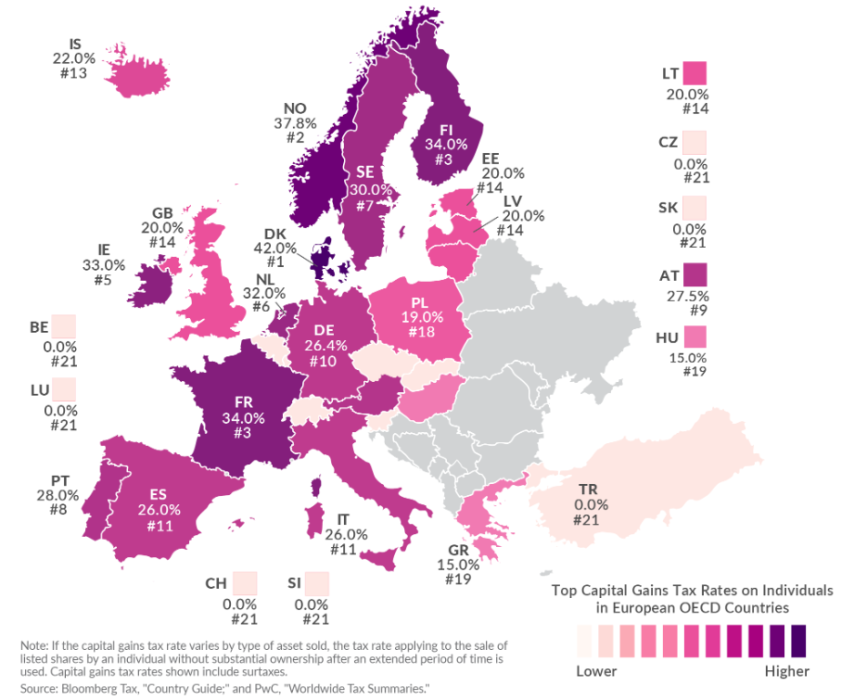

If paying 42% on capital gains doesn’t seem enticing, as it is the case in Denmark, it is better to shift attention to Eastern Europe or Slovenia, Switzerland and Luxembourg, where the rate is zero. There are also some places that offer temporary benefits for digital nomads, such as Malta or Portugal. We will definitely do a detailed tax analysis, but in the meantime, look at the excellent cheat sheet prepared by the Tax Foundation.

To help you decide, here is a little quiz

The mindset between early-stage non-European and European investors is still markedly different. That is why it's best to determine in advance not only where you like to live but also what working approach resonates with you the most.

To compare Europeans with Americans (given that the latter are still leading in VC investing), we've combined our insights with the wisdom from Serhat Pala, a seasoned entrepreneur and GP at Cross Ocean Ventures. So here are a few questions to gauge how well Europe aligns with your investor lifestyle. Perhaps we should've kicked things off with this 😄.

- Are you inclined to invest in the founder or the concept?

- Do you lean toward the practicality or the novelty of an idea?

- Does your risk tolerance spike as a project's potential grows, or do you remain sober even when a unicorn is on your doorstep?

- Do you prioritize a founder's previous successful exits or the strength of their current pitch deck/MVP?

- Do you expect significant returns from a startup within a year, or are you patient enough to wait longer?

So, if you're more in tune with the questions’ first option, you're exhibiting an American angel mentality. If you're in agreement with the second, you will surely find your fit in Europe!

Cover image: Unsplash

Uniborn is a community-led platform for sourcing, sharing, syndicating, and amplifying startups.

Uniborn is a trade name of Uniborn OÜ, registry code 16515953, Rotermanni 6, Tallinn, 10111, Estonia.

We are not intended to be a substitute for legal, tax or financial advice.

Uniborn OÜ is licensed by the Estonian FIU as Trust and Company Service provider, operating license FIU000420.