Weekly VC Insights by Uniborn #24

Hey there! We're plunging headlong into the world of analytics this week. If you're looking for a break from all those numbers, be sure to take a peek at last week's digest for some intriguing articles and podcasts. Hit that subscribe button, and let's roll!

🔥 Europe may cultivate the smartest businesses in the world

Generative AI capabilities have captured everyone's attention. But for it to truly benefit businesses, they must transform across the board — digitalize processes, collect data, train employees, and more. Not every company is ready to invest heavily in this endeavor. It is quite an undertaking.

Yet Europe appears to be home to the most forward-thinking top managers. According to a recent Accenture survey, among 2,300 top-level executives, a remarkable 91% of European companies are allocating a significant portion of their budgets to generative AI initiatives, while North America’s figure is 87%.

At the same time, Dealroom's data suggests that, in fact, about 90% of all global venture investments in generative AI are raised by American companies. Moreover, according to the same Accenture report, 42% of Europeans struggle to recruit suitable talent to support these projects, compared to only 34% of Americans.

Find more details in the Tech.eu review.

🔥 European fintech is on the verge of adapting to new realities and (we hope) starts growing soon

Every new report we've analyzed at Uniborn fuels our optimism that the venture winter might end in the near future — perhaps even next year.

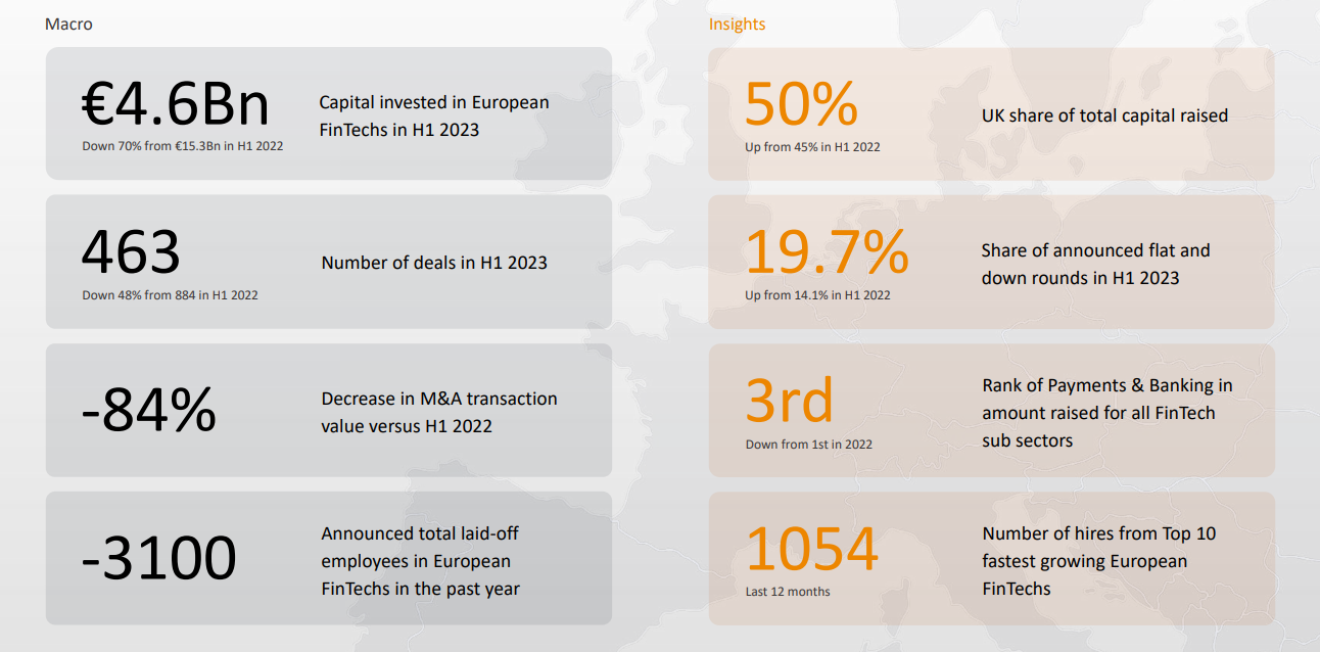

One source of encouragement is Finch Capital, which recently released its eighth annual report on the state of European fintech. According to their assessment, the year 2023 will still bear the scars of the challenging (too weak a word) 2022. In the first half of this year, the sector saw a crash in funding by over two-thirds, dropping to €4.6 billion from the robust €15.3 billion during the same period in 2022.

However, as Radboud Vlaar, managing partner at Finch Capital, emphasized, "This will continue to be painful for the next 12 months, but will result in a more healthy and sustainable Start-up, Hiring and Investor ecosystem."

Find more details in the Finch Capital paper.

🔥 "New Nordics" are officially all about deeptech and venture boom

The industry titans, including Dealroom, Iron Wolf Capital, Google Cloud, Walless, and Startup Latvia, have joined forces to make one thing clear: the Baltics region, often referred to as the New Nordics, is a true investment hotbed. This is especially true about early-stage (€0-€15M) and breakout-stage (€15-€100M) funding and even more so when the topic of cutting-edge technologies, such as AI, comes up.

This exciting development is outlined in the inaugural Baltic Deep Tech Report, and here's the scoop:

- Over the past five years, investors have significantly stepped up their game in the region. In 2021 and 2022 alone, Baltic startups secured more than €4 billion in funding, surpassing all previous years combined. Even in 2023, when the VC scene elsewhere was cooling down, Baltic startups managed to secure an impressive €516 million.

- The spotlight is set on deeptech and artificial intelligence startups. Over the past five years, Baltic innovative companies have raised a whopping €700 million, accounting for 10% of total VC investment in the region. In 2023, deeptech startups raised over a quarter (€94 million). In addition, a staggering 54% of the total startup value there now comes from the deeptech and AI sectors.

- The Baltic States are witnessing a deep tech surge, with growth rates outpacing most European and global regions. Since 2018, the collective enterprise value of local deeptech startups has more than quadrupled, being outrun only by the Nordic region that achieved a remarkable five-fold growth.

Find more details in the Baltic Deep Tech Report 2023.

Cover image: Unsplash

Uniborn is a community-led platform for sourcing, sharing, syndicating, and amplifying startups.

Uniborn is a trade name of Uniborn OÜ, registry code 16515953, Rotermanni 6, Tallinn, 10111, Estonia.

We are not intended to be a substitute for legal, tax or financial advice.

Uniborn OÜ is licensed by the Estonian FIU as Trust and Company Service provider, operating license FIU000420.